Uncategorized

Government: Minha Casa Minha Vida can ZERO the down payment, facilitating financing

Government: Buying your own home through Minha Casa Minha Vida is not free, there is a need to pay for the financing installments.

Advertisement

Government: A buying your own home through Minha Casa Minha Vida It is not free, there is a need to pay for the financing installments. The idea in this program is that families obtain special payment conditions, including lower interest rates and now the possibility of purchasing without a down payment. In other words, it will not be necessary to give no value to start financing, just pay the installments.

There is a study of Ministry of Cities team, responsible for Minha Casa Minha Vida, which aims to offer financing without entry into the program. The measure would apply to families included in range 1 who have monthly income limited to R$ 2,640. These people already receive subsidies that can reach 95% of the value of the property, that is, at least 95% is paid by the federal government.

The idea now is to get partnership with state and municipal governments so that the full entry value of the property is fully financed by the public authorities. Another possibility, if the combination of these resources is insufficient, would be the use of resources coming from FGTS (Service Time Guarantee Fund).

According to members of the Palácio do Planalto and the Ministry of Cities, they say that the entrance fee, which is usually at least 20% of the property price for this range, has created barriers for the poorest population to be served by Minha Casa Minha Vida.

Track 1 of Minha Casa Minha Vida will be more popular

The idea of benefiting track 1 of Minha Casa Minha Vida comes from the last government, chaired by Jair Bolsonaro (PL) in which the popular housing program was called Green and Yellow House. At that time the old Ministry of Regional Development started to allow parliamentary amendments to be used to reduce the amount of entry paid by low-income people.

This group has a greater investment, as they have a lower income range, therefore are less likely to pay high amounts from the program. They have access to:

- Subsidies that reach 95% of the value of the property;

- Increase in the income limit band from R$ 1,800 to R$ 2,640;

- More advantageous interest rates.

About the author / Tiago Menger

Trending Topics

FGTS: Check out 15 WITHDRAWAL possibilities here

In order to withdraw the Service Time Guarantee Fund (FGTS), certain specific circumstances need to be met by the worker.

Continue lendo

WHITE VINEGAR: See the Real Reason Why Brazilians Put It in the Washing Machine

Are you in the habit of adding a little white vinegar to your washing machine? By the end of this article you will certainly adopt this practice.

Continue lendo

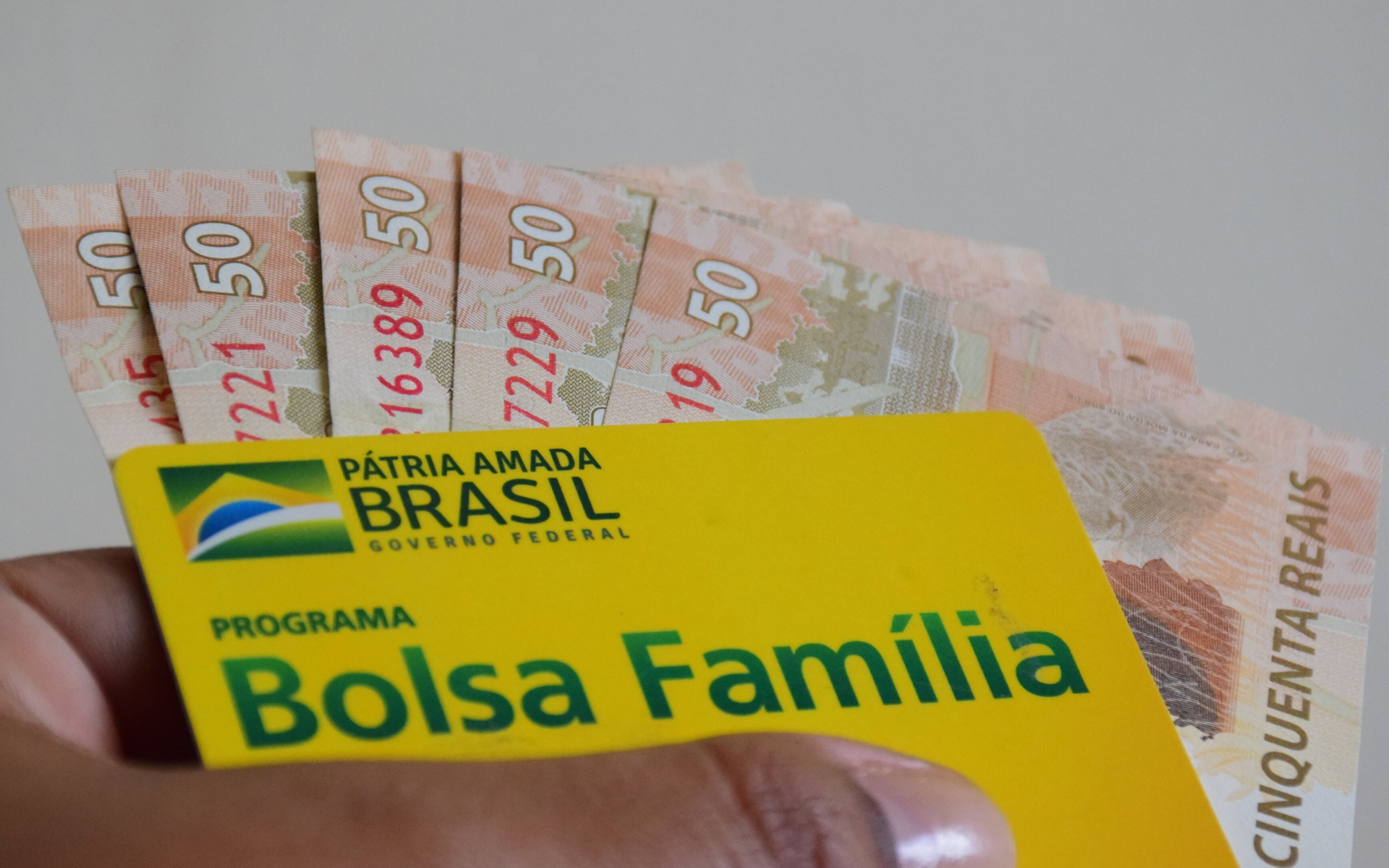

Bolsa Família: could the 13th salary come out in 2023? check out

Although the Federal Government has already declared that it will not pay the 13th salary of Bolsa Família, the opposition intends to change this.

Continue lendoYou may also like

Government goes back and interest on INSS payroll is expected to increase in the coming weeks

The last week has been tumultuous when it comes to the INSS payroll issue. After a reduction in the interest ceiling for the credit modality

Continue lendo

Bolsa Família: Government announces dates for the month of March

Payment of the New Bolsa Família began on Monday, March 20th. In March, the average value is R$ 669.93, but this will change.

Continue lendo

INSS: See the calendar dates for the month of March

The INSS will resume deposits of pensions for the month of March for more than 37 million insured people in 2023 from the 27th.

Continue lendo