Uncategorized

Auxílio Brasil: When will the loan be released to beneficiaries?

The new forecast for the release of the Auxílio Brasil loan to beneficiaries is scheduled for the month of October.

Advertisement

Government authorities met in recent days to finalize the final details of the Auxílio Brasil allocation. The new forecast for credit to be available to beneficiaries is in October.

In September, the social program reached a record number of 20.65 million benefiting families. A large part of this group is always looking for information to find out when the Auxílio Brasil loan will be available.

Firstly, the Auxílio Brasil loan was scheduled to be released by the end of August. The government later extended the deadline to early September.

As the days passed and the end of the month approached, the Citizenship department informed in a note that the government is working with other bodies to release the loan modality, but there is still no specific date for the concession to begin.

When will the loan be released to beneficiaries?

There is still no definitive date to start the Auxílio Brasil loan. According to the Ministry of Citizenship, the government is in “constant negotiations” to guarantee the loan for more than 20 million families.

According to the Uol portal, members of the Economy, Citizenship and Civil House held meetings last week to finalize the details on the launch of the consignment modality. It is estimated that by the end of October the government will publish the rules and authorize institutions to offer the loan

Which banks are already offering the loan?

Since the law expanding payroll loans for Auxílio Brasil families came into force, some financial institutions have already spoken out about offering the new loan modality.

On the other hand, the large banks also announced that they will not offer the Auxílio Brasil payroll loan. By August, the Minister of Citizenship said that 17 institutions had been approved to offer the loan.

See some of the 17 banks that will offer this loan modality:

- AgiBank

- PAN Bank

- Caixa Econômica Federal

Other banks such as Bradesco, Santander, Nubank, Banco Inter, Itaú/Unibanco, Banco C6 and Sicoob have already informed that they will not offer payroll loans to beneficiaries of social programs.

Recently, Banco Safra, which was initially going to offer the Auxílio Brasil loan, suspended operations with the loan modality. See what the bank said:

“Due to ongoing legal and regulatory discussions, we inform you that proposed operations of this nature cannot be carried out or concluded at this time, to guarantee legal certainty and the protection of customers.”

The interest ceiling on Auxílio Brasil payroll loans

One of the government's biggest challenges is resolving the issue of the interest rate ceiling on the Auxílio Brasil loan. The Ministry of Citizenship's initial idea was not to establish a limit on what financial institutions could charge beneficiaries, but the matter was reevaluated by government members.

With the publication of the law and decree in the Official Gazette of the Union, without indicating a maximum interest ceiling, some financial institutions began to announce interest rates of up to 79% per year for low-income families.

The situation alienated institutions that did not want to be associated with the image of exploitation of this part of the population, already living in extreme poverty and who could become even more indebted with the high interest rates announced.

The impasse becomes even greater when the modality is compared to the payroll of INSS retirees, whose rate is 2.14% per month (around 26.9% per year). However, the institutions claim that the insured person's benefit is a permanent guarantee, while in the Auxílio Brasil program the family may no longer receive the benefit.

In Auxílio Brasil, families that do not comply with the rules or requirements of the program run the risk of losing the benefit and being excluded from the program.

Therefore, it is necessary for the government to establish a way for families to continue paying the loan even after they stop receiving Auxílio Brasil. These and other details must be published in the Official Gazette of the Union before financial institutions begin offering payroll loans.

See more:

About the author / Tiago Menger

Trending Topics

Auxílio Brasil: Anticipation in October is confirmed; See the new dates

Auxílio Brasil’s October calendar has been brought forward. Scheduled to start on the 18th, the new schedule starts on October 11th.

Keep Reading

Auxílio Brasil: TCU MP asks for the suspension of the payroll loan

After the Federal Government approved the consignment modality for Auxílio Brasil beneficiaries, the Public Ministry together with the TCU filed a request in court to suspend the consignment grant.

Keep ReadingYou may also like

Google launches Chromebooks focused on cloud gaming

Google launched this Tuesday (11) new Chromebooks focusing on the use of cloud gaming services. The models result in the company's partnership with different manufacturers.

Keep Reading

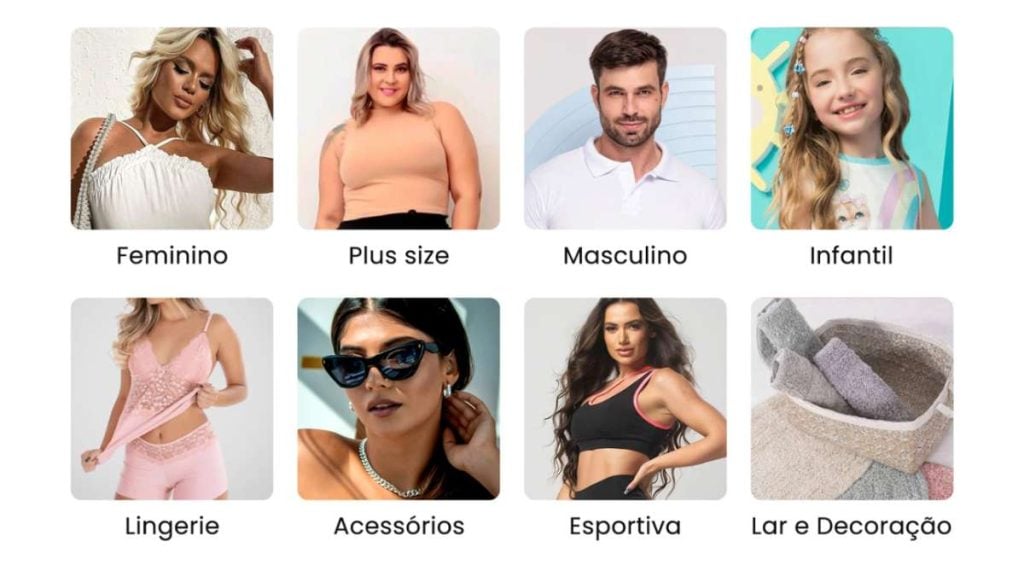

See how to use Shein coupons and save even more

See what Shein coupons are, what are the best strategies for obtaining them and how they can help you save even more!

Keep Reading